Spread The Cost

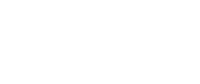

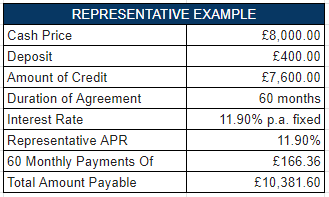

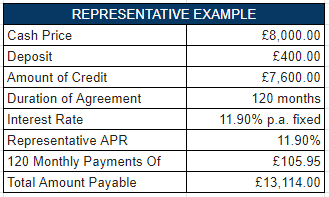

We offer 11.9% interest bearing over 60 months¹, 120 months² or 168 months³. There are no set-up fees – this options is a firm favourite with Dunraven’s customers. A minimum deposit is required, but is simply your purchase price less the deposit divided by the number of repayments.

Great Rates of Interest

With a low rate finance option you can spread the cost up to 10 years at a fantastic rate of interest. There are no set-up fees, plus you have the option to make additional repayments which could reduce the term of the agreement and the amount of interest payable. With low rate finance you could have your dream home improvement quicker than you think.

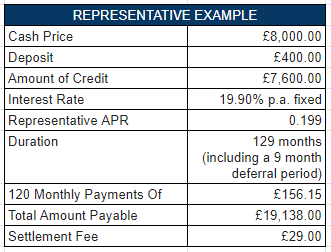

Buy now pay in 9 months spread the cost 19.9% APR Representative

With buy now pay later¹¹ there’s nothing to pay for 9 months. This deferral option is perfect for customers who don’t want to wait for their home improvements but also want to free up their savings for other purchases. Within the deferral period of your order (see loan agreement for specifics), pay the outstanding balance plus a £29 exit fee and incur no interest. If not settled within that period, interest will have accrued from the inception of your contract and will continue to be charged and you will begin 120 monthly repayments at the representative APR above. If the customer is to pay partial payments, the interest is then adjusted on the balance remaining.

Representative Examples

Please click the drop down boxes to view our different Representative Examples. Please don’t hesitate to get in touch with us if you have any questions or would like further information on our finance options.

* Credit is subject to application and status

Credit is subject to status and affordability. Braceys Limited, St. David’s House, Heol Mostyn, Village Farm Industrial Estate, Pyle, Bridgend, CF33 6BJ, trading as Dunraven Windows, is a credit broker, not the lender and is authorised and regulated by the Financial Conduct Authority. Credit is provided by a panel of lenders with whom we have a commercial relationship. We may receive a commission from the lenders.

Minimum spend and eligibility criteria applies. Subject to application, financial circumstances and borrowing history,